17 Different Candlestick Formations To Identify the Trend in Market for Profitable Trading

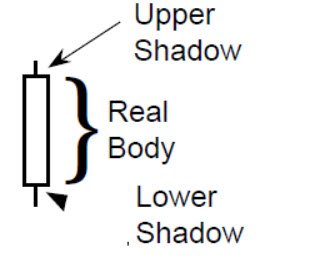

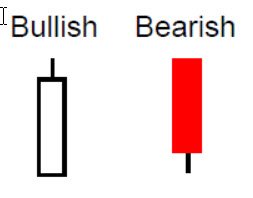

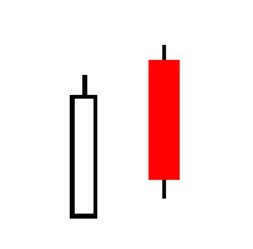

Japanese Candlestick lines and charts

Traditional Japanese charts whose individual lines look like candles, hence their name. The candlestick line is comprised of a real body and shadows. See “Real body” and “shadow.”

1. Belt-hold line

Belt-hold line – there are bullish and bearish belt holds. A bullish belt hold is a tall white candlestick that opens on its low. It is also called a white opening-shaven bottom. At a low price area, this is a bullish signal. A bearish belt hold is a long black candlestick that opens on its high. Also referred to as a black opening-shaven head. At a high price level, it is considered bearish

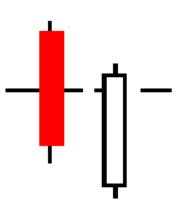

2. Counterattack Lines

Counterattack lines — following a black (white) candlestick in a downtrend (uptrend), the market gaps sharply lower (higher) on the opening and then closes unchanged from the prior session’s close. A pattern that reflects a stalemate between the bulls and bears.

3. Dark-cloud cover

Dark-cloud cover- a bearish reversal signal. In an uptrend, a long white candlestick is followed by a black candlestick that opens above the prior white candlestick’s high. It then closes well into the white candlestick’s real body.

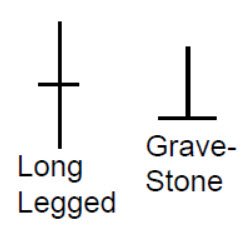

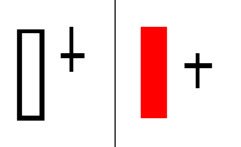

4. Doji

Doji -a session in which the open and close are the same (or almost the same). There are different varieties of doji lines (such as a gravestone or long-legged doji) depending on where the opening and closing are in relation to the entire range. Doji lines are among the most important individual candlestick lines. They are also components of important candlestick patterns.

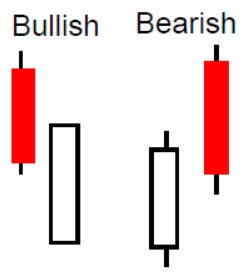

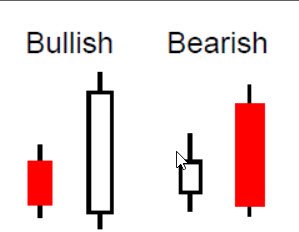

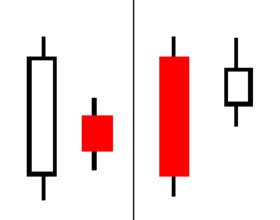

5. Engulfing Patterns

Engulfing patterns — there is a bullish and bearish engulfing pattern. A bullish engulfing pattern is comprised of a large whie real body which engulfs a small black real body in a downtrend. The bullish engulfing pattern is an important bottom reversal. A bearish engulfing pattern (a major top reversal pattern), occurs when selling pressure overwhelms buying pressure as refleccted by a long black real body engulfing a small white real body in an uptrend.

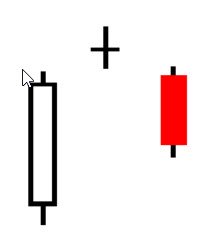

6. Doji Star

Doji star — a Doji line which gaps from a long white or black candlestick. An important reversal pattern with confirmation during the next session.

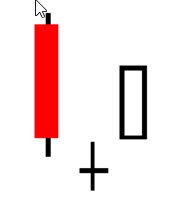

7. Evening Star

Evening star — a major top reversal pattern formed by three candlesticks. The first is a tall white real body, the second is a small real body (white or black) which gaps higher to form a star, the third is a black candlestick which closes well into the first session’s white real body.

8. Evening Doji Star

Evening doji star — the same as an evening star except the middle candlestick (i.e., the star portion) is a doji instead of a small real body. Because there is a doji in this patter, it is considered more bearish than the regular evening star.

9. Hammer

Hammer — an important bottoming candlestick line. The hammer and the hanging man are both the same line, that is a small real body (white or black) at the top of the session’s range and a very long lower shadow with little or no upper shadow. When this line appears during a downtrend it becomes a bullish hammer. For a classic hammer, the lower shadow should be at least twice the height of the real body.

10. Hanging Man

Hanging man — an important top reversal. The hanging man and the hammer are both the same type of candlestick line (i.e., a small real body (white or black), with little or no upper shadow, at the top of the session’s range and a very long lower shadow). But when this line appears during an uptrend, it becomes a bearish hanging man. It signals the market has

become vulnerable, but there should be bearish confirmation the next session (i.e., a black candlestick session with a lower close or a weaker opening) to signal a top. In principle, the

hanging man’s lower shadow should be two or three times the height of the real body.

11. Harami

Harami — a two candlestick pattern in which a small real body holds within the prior session’s unusually large real body. The harami implies the immediately preceding trend is concluded and that the bulls and bears are now in a state of truce. The color of the second real body can be white or black. Most often the second real body is the opposite color of the first real body.

12. Harami Cross

Harami cross — a harami with a Doji on the second session instead of a small real body. An important top (bottom) reversal signal especially after a tall white (black) candlestick line. It is also called a petrifying pattern.

13. Inverted Hammer

Inverted hammer — following a downtrend, this is a candlestick line that has a long upper shadow and a small real body at the lower end of the session. There should be no, or very little, lower shadow. It has the same shape as the bearish shooting star, but when this line occurs in a downtrend, it is a bullish bottom reversal signal with confirmation the next session (i.e., a white candlestick with a higher close or a higher opening).

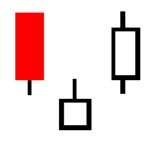

14. Morning Star

Morning star — a major bottom reversal pattern formed by three candlesticks. The first is a long black real body, the second is a small real body (white or black) which gaps lower to form a star, the third is a white candlestick that closes well into the first session’s black real body.

15. Morning Doji Star

Morning doji star — the same as a morning star except the middle candlestick is a doji instead of a small real body. Because there is a doji in this pattern it is considered more bullish

than the regular morning star.

16. Piercing pattern

Piercing pattern – a bottom reversal signal. In a downtrend, a long black candlestick is followed by a gap lower during the next session. This session finishes as a strong white Candlestick which closes more than halfway into the prior black candlestick’s real body. Compare to the on-neck line, the in-neck line, and the thrusting line.

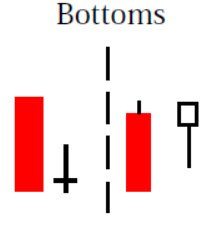

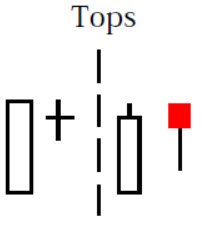

17. Tweezers top and bottom

Tweezers top and bottom — when the same highs or lows are tested the next session or within a few sessions. They are minor reversal signals that take on extra importance if the two candlesticks that comprise the tweezers pattern also form another candlestick indicator. For example, if both sessions of a harami cross have the same high it could be an important top reversal since there would be a tweezers top and a bearish harami cross made by the same two candlestick lines.