Menu

≡

╳

- See the performance yourself, Register your FREE DEMO now

- info@wintradersoft-com.mars-cdn.com

-

follow us

-

FacebookOur group on Facebook to discuss with WinTrader BUY SELL Signal generating software and Trading systems

-

YouTubeWe publish and share video tutorials whenever it released, keep in touch with in our YouTube

-

Google+Our Google + page will discuss you with the latest updates in WinTrader BUY SELL Signal generating software and Trading systems

-

TwitterFollow us on Twitter for important industry news and latest updates in WinTrader Trading Systems

-

PinterestOn our Pinterest we share the latest screen shot of WinTrader BUY SELL signal software

-

InstagramWant to learn more about WinTrader Trading Systems? On Instagram we share our software screen shots.

-

- Blog

Click Here To Register Free Demo

1

Step 1

Previous

Next

WinTrader Buy Sell Signal Software Category: Japanese Candlesticks

The best and highly accurate buy sell signal software for MCX, NSE, FOREX, MCX SX, NCDEX, COMEX markets. Take our FREE LIVE DEMO to see the performance.

CLICK HERE to visit our HOME PAGE for more details about WinTrader BUY SELL signal software for Commodity/Stock/Currency markets.

CLICK HERE to register our free demo

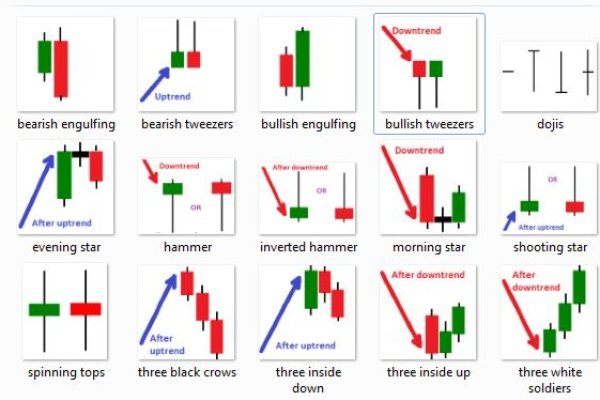

Japanese Candlestick lines and charts Traditional Japanese charts whose individual lines look like candles, hence their name. The candlestick line is comprised of a real body and shadows. See "Real body" and "shadow." 1. Belt-hold line Belt-hold line - there are bullish and bearish belt holds. A bullish belt hold is a tall white candlestick that opens on its low. It is also called a white opening-shaven bottom. At a low price area, this is a bullish signal. A bearish belt hold is a long black candlestick that opens on its high. Also referred to as a black opening-shaven head. At a high price level, it is considered bearish 2. Counterattack Lines Counterattack lines -- following a black (white) candlestick in a downtrend (uptrend), the market gaps sharply lower (higher) on the opening and then closes unchanged from the prior session's close. A pattern that reflects a stalemate between the bulls and bears. 3. Dark-cloud cover Dark-cloud cover- a bearish reversal signal. In an uptrend, a long white candlestick is followed by a black candlestick that opens above the prior white candlestick's high. It then closes well into the white candlestick's real body. 4. Doji Doji -a session in which the open and close are the same (or almost the same). There are different varieties of doji lines (such as a gravestone or long-legged doji) depending on where the opening and closing are in relation to the entire range. Doji lines are among the most important individual candlestick lines. They are also components of important candlestick patterns. 5. Engulfing Patterns Engulfing patterns -- there is a bullish and bearish engulfing pattern. A bullish engulfing pattern is comprised of a large whie real body which engulfs a small black real body in a downtrend. The bullish engulfing pattern is an important bottom reversal.…